Why Is Digital Marketing Important for Financial Advisors Today?

12.5 min

12.5 min

The advisory profession has entered a moment of real scrutiny. Clients no longer wait for recommendations or rely on a single source of influence. They scan search engines, study online profiles, examine thought leadership, and compare firms quietly. This behaviour shift forms the backbone of understanding why digital marketing is important for financial advisors. The modern client wants clarity. They want evidence. They want a clear sense of who understands their concerns before scheduling a conversation.

This blog aims to break down the realities behind that shift. Not a surface summary. A direct, thesis-style exploration of how digital engagement, data-driven visibility, and structured content ecosystems now shape advisor growth. Readers deserve an honest, transparent analysis. So we begin with the forces that triggered this migration to digital channels.

Why Financial Advisors Are Moving Toward Digital First Markets

Online Research Habits

Individuals planning investments, retirement paths, or wealth decisions investigate online first. They search queries that reveal intent. They study reviews. They compare expertise. This single habit explains why digital marketing is important for financial advisors. The evaluation process begins long before the advisor becomes aware of the prospect. Whoever shows up with clarity earns attention.

Transparency Expectations

People want explanations they can rely on. They want transparency. They want advisors who do not speak in abstraction. Digital ecosystems support that expectation. This shifts digital marketing for financial advisors from being a promotional tool to becoming a knowledge platform that builds informed trust.

Broader Competition Landscape

Independent advisors, boutique firms, and large institutions now appear in the same search results. Discovery is no longer limited by location or referral circles. This broadens the significance of digital marketing services of financial advisors. The advisor with the clearest voice, most accessible information, and strongest presence often gains the first conversation.

AI Driven Visibility

AI Overviews, conversational results, and knowledge panels now assess relevance differently. Advisors who organise their expertise into structured, high-value content surface more consistently. This is another factor behind why digital marketing is important for financial advisors. The mechanics of discovery have changed and expertise must be visible in formats that these systems favour.

Let us pause for a moment. This shift did not happen abruptly. It formed slowly through changing habits. Now that we have unpacked the cause, we can move into the outcomes.

Ready to Strengthen Your Digital Presence?

A focused advisory brand needs structured visibility. Unlock a customised roadmap that elevates trust, reach, and digital influence across client touchpoints.

Start Now

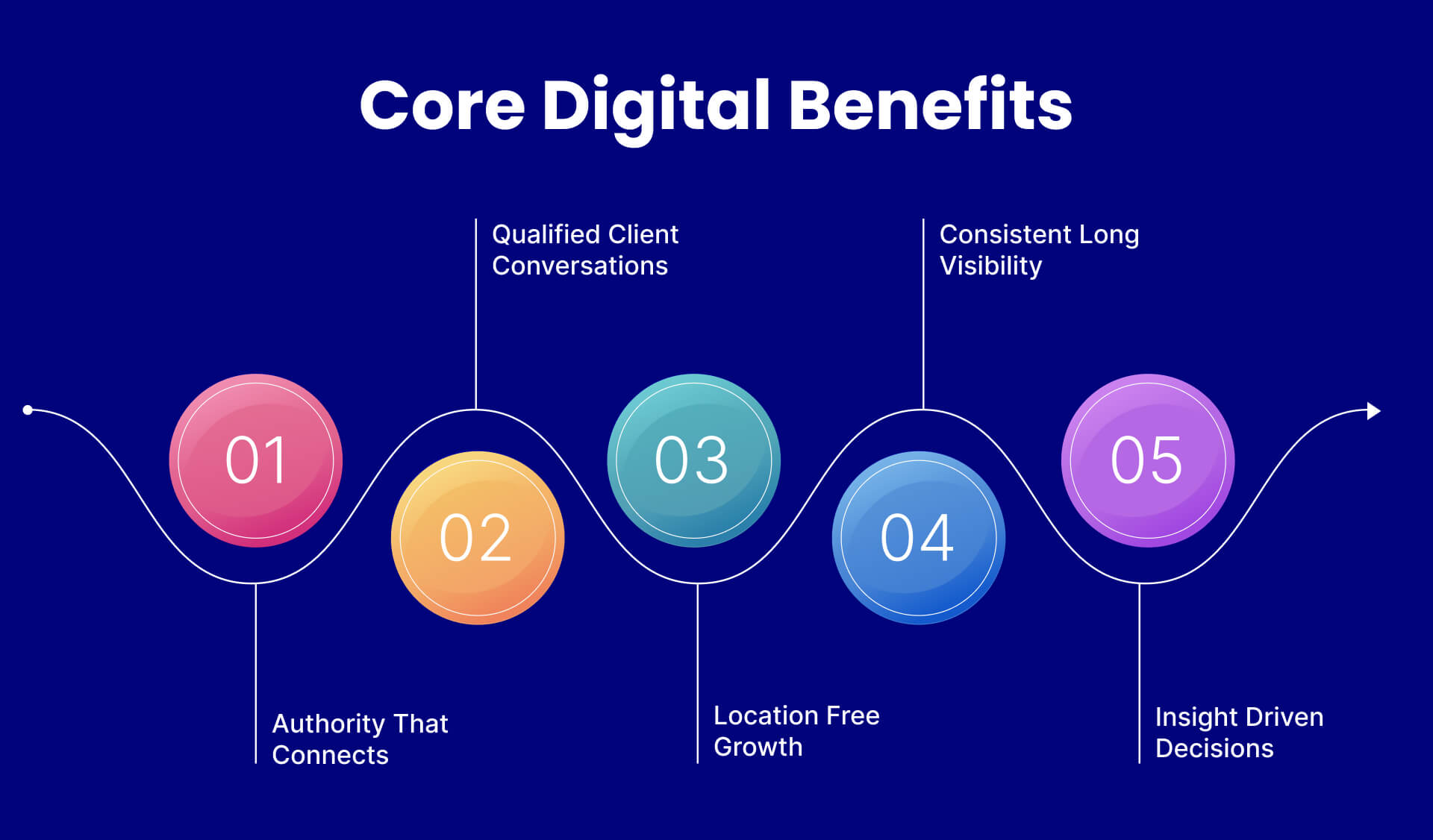

Benefits of Digital Marketing for Financial Advisors

Authority That Connects

When prospective clients search for guidance, they respond to expertise that feels credible. Consistent educational content helps them form an early impression of the advisor’s capability. This is one of the foundational reasons why digital marketing is important for financial advisors. Trust is built through repeated exposure to useful, accurate, and thoughtful insights.

Qualified Client Conversations

Digital channels attract clients who have actively researched their financial concerns. They arrive informed. They arrive with intent. This creates efficiency. It also strengthens the role of digital marketing for financial advisors because the advisor steps into discussions where the prospect is already aware of their expertise and approach.

Location Free Growth

Advisors can now serve clients across states or countries by building robust digital reputations. This makes digital marketing services of financial advisors a strategic asset for expanding reach without operational complexity. Search systems amplify voices that demonstrate consistent knowledge and responsible communication.

Consistent Long Visibility

Once high-quality content is established, it continues to attract audiences. It works quietly behind the scenes. It positions the advisor in search engines, AI summaries, and niche financial queries. This long-term value explains why digital marketing is important for financial advisors who want durable growth rather than cycles of unpredictability.

Insight Driven Decisions

Advisors can observe which topics matter to clients. They can understand search patterns and content engagement. This informs both product and communication decisions. It converts digital marketing for financial advisors into a research tool, not just a visibility channel.

Before we proceed to the next section, take a moment. These benefits reveal a larger truth. The advisory profession is becoming a digital knowledge discipline. In the next chapter, we break down the strategies that bring this shift to life through AIO, AEO, and GEO-aligned frameworks.

Key Digital Marketing Strategies for Financial Advisors

Financial advisors operate in a high-trust field. The audience evaluates skill, clarity, and consistency long before they initiate a conversation. This is why digital marketing is important for financial advisors who want sustained visibility in search engines, AI summaries, and location-based discovery systems. Let us walk through strategies that align with how clients search, how algorithms interpret expertise, and how regions influence decision making.

AI Ready Structure

Every advisor produces content at some point, yet few build it in a sequence that teaches search systems how their expertise connects. AIO thrives on clarity. Advisors need topic clusters that move from foundational guides to specific concerns. This sequence helps AI models understand the advisor’s domain. It also strengthens the role of digital marketing for financial advisors because search systems reward content that feels helpful and well connected. Create pages that explain retirement planning, investment principles, risk profiling, tax implications, and wealth strategies in a structured order. The clearer the sequence, the stronger the relevance score seen by AI platforms.

Intent Aligned Search

AEO responds to accuracy. Advisors need content that gives direct answers before diving into context. This is where many firms lose visibility. People want answers they can trust. They want explanations that feel responsible. This makes digital marketing services of financial advisors more impactful when combined with clean Q and A formats, definition blocks, step based clarity, and simplified explanations. Examples include simple explanations of planning concepts, retirement timelines, investment product selection factors, and frequently asked questions written in a clear, uncluttered style.

Location Based Trust

People still search locally for advisory support, even if meetings happen virtually. GEO requires an understanding of how location specific queries influence visibility. Advisors need pages dedicated to local terminology, local tax conditions, local financial concerns, and local decision behaviours. Location pages, regional terminology, and city based content help search engines trust the advisor’s relevance to a specific market. This strengthens the fundamental value of digital marketing for financial advisors because many decisions still begin with hyperlocal searches.

Credible Authority Signals

Thought leadership, financial publications, expert panels, and interviews shape an advisor’s digital footprint. Search systems interpret this as legitimacy. This explains another dimension of why digital marketing is important for financial advisors. Authority spreads influence. Advisors should repurpose long form content into article features, podcast appearances, opinion columns, and educational videos that present clear value. Once AI systems detect the advisor across multiple sources, they begin to treat the advisor as a reliable entity.

Consistent Trust Engagement

Trust does not appear through a single post. It develops slowly. Advisors who send newsletters, host Q and A sessions, publish consistent insights, and share updates create a cycle of engagement. This cycle influences AIO and AEO ranking signals because engagement indicates content usefulness. This strengthens digital marketing services of financial advisors by converting passive readers into informed prospects.

We have walked through the structural strategy. Now let us pivot to something more immediate. Many advisors want a quick checklist. Useful. Practical. Simple enough to act on today.

Want Authority That Converts Clients?

Position your expertise where decisions start. Build a digital footprint that reflects trust, clarity, and advisory strength before the first call.

Build Authority

AIO, AEO, and GEO Optimisation Checklist for Financial Advisors

- Publish detailed topic clusters around financial planning concepts.

- Answer key advisory questions in clear, direct sentences within the first three lines.

- Maintain a consistent voice throughout all content formats.

- Create landing pages shaped for local search queries relevant to your region.

- Add FAQ sections that align with the way real users phrase their doubts.

- Optimise titles, meta data, headers, and Q and A blocks for precision based discovery.

- Build linkable assets such as guides and checklists that credible websites can reference.

- Use structured data that helps AI and search engines read your content with accuracy.

- Create local profiles that reflect complete information with the same details across platforms.

- Ensure all content aligns with compliance guidelines and remains factually sound.

Let us shift to the final section. You have seen the strategies. You have the checklist. Now the natural question arrives. Who helps you execute this correctly. That is where Edifying Voyages enters the picture.

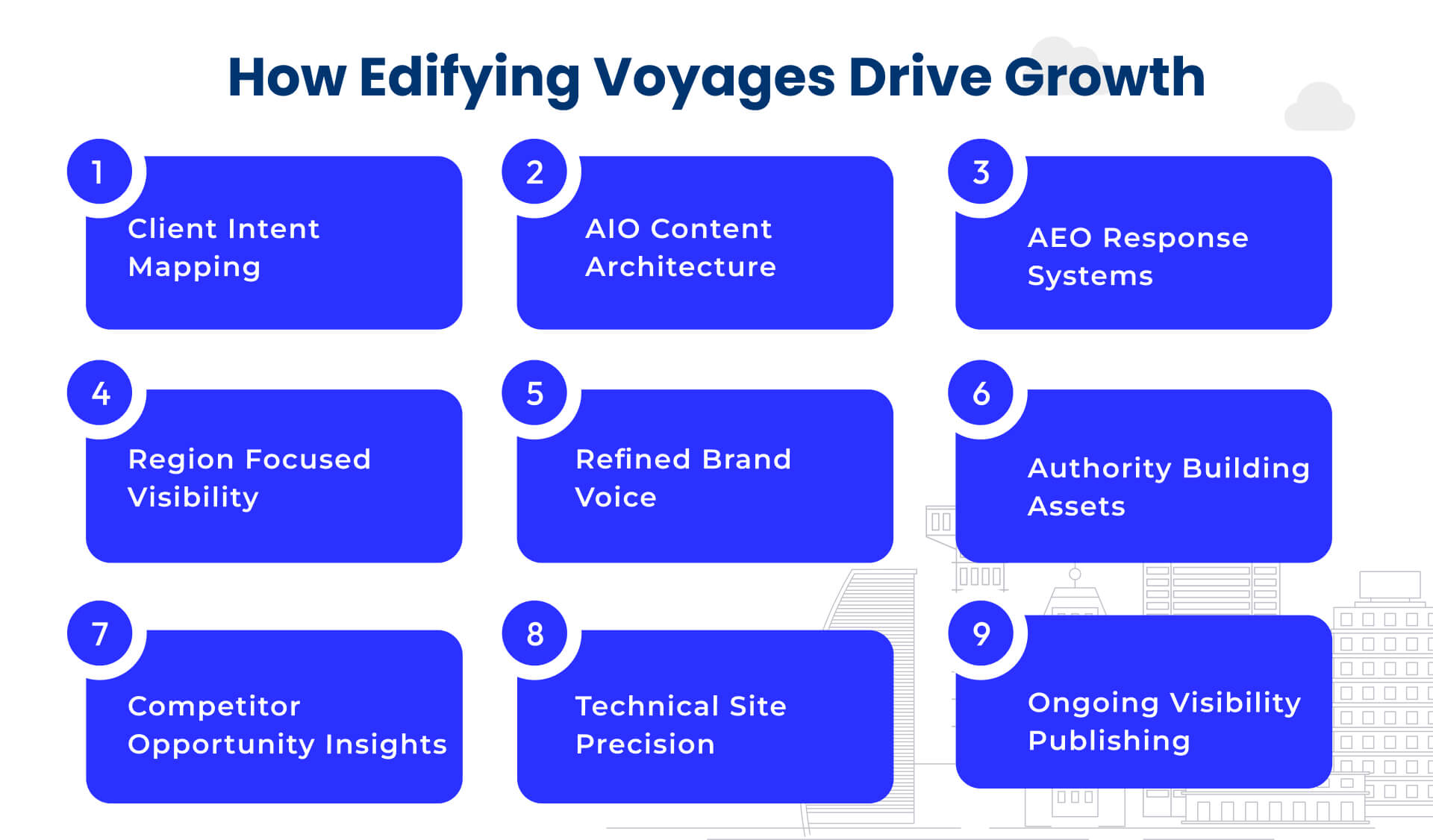

How Edifying Voyages Strengthens Digital Growth for Financial Advisors

Financial advisors often know exactly how to guide clients, yet the digital world rarely mirrors that expertise with the clarity it deserves. This gap is where Edifying Voyages steps in. The firm approaches advisory growth with a strategic and evidence led model that blends content, search systems, behavioural insight, and regional dynamics into one cohesive structure. The goal is simple. Your expertise should be visible, trusted, and discoverable at every relevant touchpoint.

1. Client Intent Mapping

Edifying Voyages begins with a detailed study of how your ideal clients search for guidance. The team examines long form queries, behavioural patterns, advisory concerns, retirement planning interests, investment questions, and regional planning needs. This foundation shapes the strategy. It also ensures that digital marketing for financial advisors addresses genuine client intent rather than assumptions.

2. AIO Content Architecture

Once the search landscape is clear, Edifying Voyages converts your expertise into a structured content architecture. This includes long form guides, advisor education pages, sequencing of topics, and clarity based explanations. The purpose is to help AI systems correctly interpret what you specialise in. This reinforces why digital marketing is important for financial advisors who want to be surfaced in AI driven results across modern platforms.

3. AEO Response Systems

People approach financial searches with caution. They want precise answers. They want simple explanations without losing depth. Edifying Voyages builds Q and A structures, definition sets, and search friendly responses that strengthen your visibility across question based queries. This is where digital marketing services of financial advisors gain momentum because the structure directly aligns with how search engines evaluate clarity.

4. Region Focused Visibility

Advisors often operate across multiple cities, yet their digital presence does not reflect those regional nuances. Edifying Voyages creates location focused pages, regional financial terminology, localised planning insights, and city based content variations. These assets support GEO visibility and expand your influence beyond your immediate environment. This also supports long term scalability without office based expansion.

5. Refined Brand Voice

The firm studies your advisory style and translates it into a clear, consistent identity across all platforms. This includes advisor profiles, firm narratives, trust signals, compliance aligned messaging, and thought leadership planning. The aim is to strengthen how clients perceive you before they speak with you. This is another important reason why digital marketing is important for financial advisors building authority.

6. Authority Building Assets

Visibility improves when advisors appear in credible ecosystems. Edifying Voyages designs publication strategies, expert commentary opportunities, podcast placements, feature articles, and educational assets that create external validation. Search systems recognise this consistency and begin treating your brand as a reliable financial source.

7. Competitor Opportunity Insights

The firm studies your competitors across local and global markets. This includes understanding what content lifts their visibility and where their gaps exist. The findings create opportunity zones. These zones show where your firm can dominate with better insights, clearer positioning, or stronger regional relevance. This strengthens digital marketing services of financial advisors by revealing paths that competitors have not fully utilised.

8. Technical Site Precision

Behind every strong digital presence is a technical foundation that search engines trust. Edifying Voyages ensures that page architecture, crawlability, metadata, link structures, and schema elements remain clean and precise. This clarity enhances AIO and AEO signals and builds a reliable platform for ongoing growth.

9. Ongoing Visibility Publishing

Financial advisory growth depends on consistent presence. Edifying Voyages manages monthly publishing rhythms, seasonal content strategies, quarterly visibility audits, and performance reviews. The team measures the frequency of publishing and adapts the plan to match changing search behaviour. This creates sustained momentum and builds durable visibility across platforms.

Every step in this model is grounded in clarity. Each decision is shaped by behavioural insights, search logic, and real market patterns. This is why digital marketing is important for financial advisors who want meaningful visibility and long term authority. Edifying Voyages builds the structure that makes this possible and maintains the rhythm that keeps your advisory practice relevant in a crowded industry.

Ready to Modernise Your Advisory Marketing?

Transform how clients discover, evaluate, and trust you using digital frameworks engineered for financial expertise and high-trust sectors.

Modernise Now

Conclusion

The advisory field now runs on visibility, clarity, and trust. Clients research extensively before choosing a financial guide, which explains why digital marketing is important for financial advisors who want consistent discovery across search engines and AI platforms. Strong positioning requires structured content, accurate answers, and region aware communication that reflects real client needs.

Digital marketing for financial advisors is not a promotional layer. It is a foundation that shapes authority and strengthens influence. Advisors who build organised content systems, search aligned responses, and GEO focused visibility create steady demand throughout the year.

Edifying Voyages supports this evolution through research led strategy, technical precision, and long term visibility planning. The firm helps advisors convert expertise into a presence that gains trust across markets, including teams that manage offshore digital marketing services within a unified growth model. The result is a digital ecosystem that works continuously and strengthens advisory reputation at every stage.

FAQs

Digital marketing helps advisors attract prepared clients by placing clear guidance where people search. This builds informed interest. Edifying Voyages strengthens this journey through structured visibility and well crafted content.

Advisors need it because clients evaluate expertise online before reaching out. This behaviour shapes early trust. Edifying Voyages designs systems that present your expertise with clarity and consistency.

It is valuable because it answers real financial concerns in a format people rely on. This clarity builds confidence. Edifying Voyages creates content sequences that match audience intent.

Local optimisation connects advisors with people seeking region specific guidance. This improves relevance. Edifying Voyages develops location aware content that strengthens trust in competitive markets.

They should because structured answers match how people search for financial clarity. This improves discovery. Edifying Voyages crafts response formats that search systems recognise easily.

We support growth through research driven strategy, precise optimisation, and continuous visibility planning. This creates a strong digital foundation that improves discovery and strengthens advisory credibility.