What Makes PPC Advertising for Insurance Agents So Effective

14 min

14 min

In today’s fiercely competitive insurance landscape, capturing attention isn’t just about having a catchy tagline or a friendly face on a billboard. It’s about being exactly where your potential clients are—right when they’re searching for you. That’s where PPC advertising for insurance agents becomes more than just a buzzword—it’s a critical growth strategy.

Whether you're an independent insurance agent or running a mid-sized agency, the reality is stark: relying solely on referrals or word-of-mouth isn’t enough anymore. Consumers now do their homework. They search online. They compare. They click.

And those clicks? They're gold—but only if you know how to earn them efficiently.

Pay-per-click (PPC) campaigns allow insurance agents to break through the noise, get in front of high-intent prospects, and turn interest into conversions—all while staying in full control of the budget. But while PPC might sound like a fast-track to success, navigating it without a solid understanding can be like setting your money on fire.

In this guide, we’ll break it all down—from the basics to the best platforms and practical strategies—so you’re not just spending money on ads… you’re investing in growth.

What is PPC Advertising

PPC is Pay-Per-Click. Under this digital advertising paradigm, you pay just when someone clicks on your advertisement. You did indeed hear correctly—no clicks, no fees.

Here's the quick breakdown:

- You create an ad.

- You choose specific keywords or demographics.

- Your ad shows up on search engines or social platforms.

- When someone clicks, you pay a set amount.

- Hopefully, that click leads to a sale, a call, or a form submission.

What makes ppc advertising for insurance agents so effective is that it puts your brand in front of people who are already searching for the services you provide. It's not passive, and it’s not based on hoping the right person happens to drive past your billboard during rush hour.

It's highly intentional.

One can run PPC on Google Ads, Bing Ads, Facebook Ads, and LinkedIn Ads among other platforms. The secret is exact targeting; you can focus on possible customers based on age, income, ZIP code, even life events (such as having a kid or purchasing a new house).

In short: PPC isn’t just advertising. It’s intent marketing—you appear only when someone is actively looking for what you offer.

Ready to Get More Insurance Leads?

PPC ads can bring you high-quality leads fast. Let’s build a strategy tailored to your insurance business.

Get Started!

PPC Smartest Strategy to Attract High-Intent Insurance Buyers

Insurance is obviously a difficult sell. It's complicated, not especially thrilling, and usually considered as an unneeded cost until something goes wrong. The sector is also quite competitive, with major companies pouring large sums of money into digital campaigns.

Why then does ppc advertising for insurance agents cut through the clutter?

Because it addresses individuals most inclined to act immediately.

People hunt for insurance in high-stress, highly emotional times—after an accident, while purchasing a house, or before a major life event. PPC allows you to be right there when customers require direction rather than a sales pitch. It is about visibility, intent, and time.

Another reality is that organic search takes time. Content marketing is like tending to. Consistency is something social media embraces. PPC, however? It can begin producing leads in a few hours. That is rather strong, not only handy.

Benefits of PPC Advertising for Insurance Agents

Let’s break down exactly why ppc advertising for insurance agents is not just helpful—but essential.

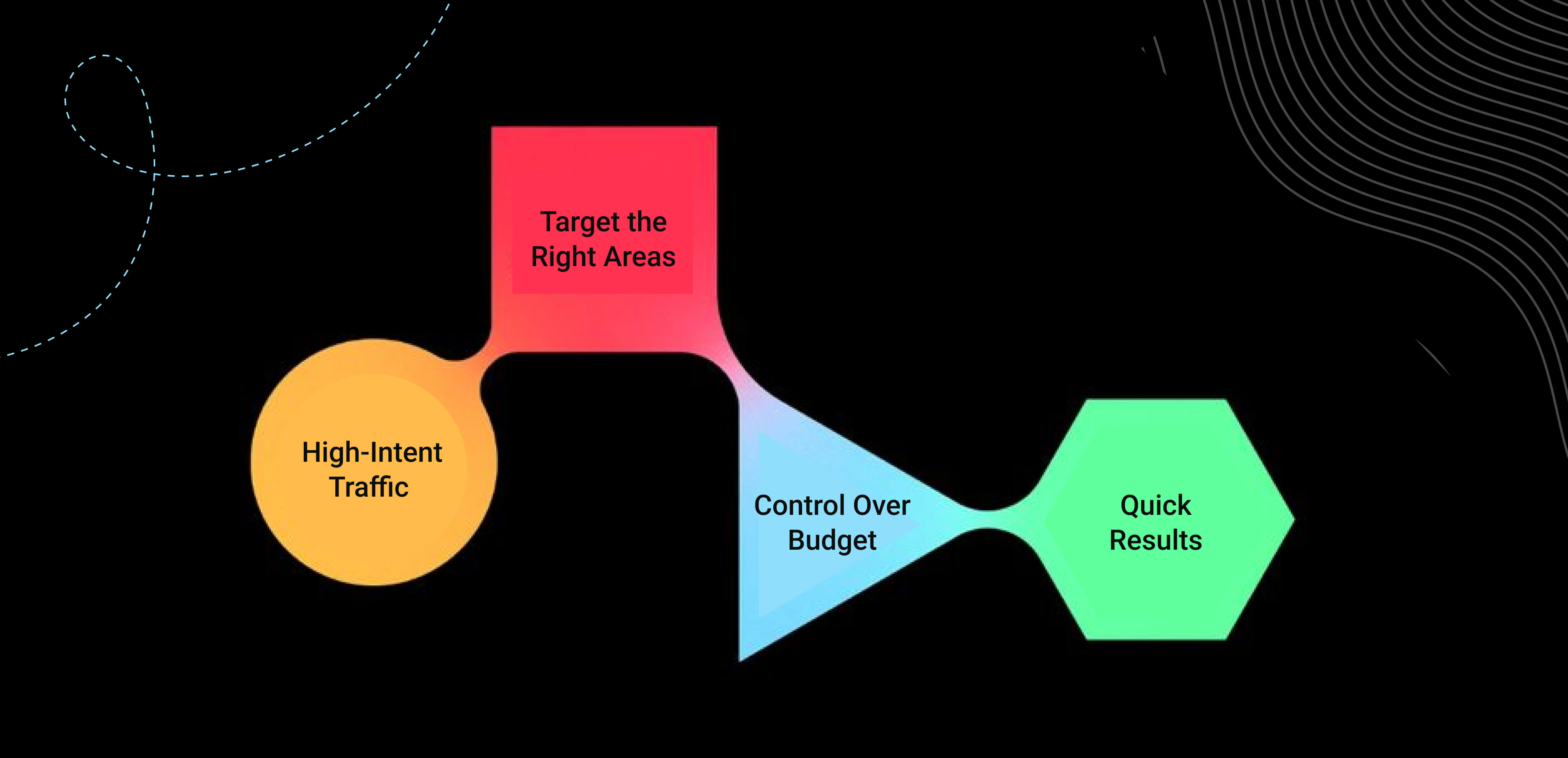

1. High-Intent Traffic

PPC lets you reach a market already seeking insurance solutions. These are not aimless people browsing a social media feed; they are actively seeking aid. For insurance brokers, that is known as commercial intent and is golden.

Your advertisement appears only when someone searches for terms like "life insurance quotes" or "home insurance in Texas." These are not laid back browsers. These are folks ready to click, phone, and turn around.

2. Target the Right Areas

In insurance, location is quite important. Someone in Florida wants a quote for coverage of California wildfires. Using ppc advertising for insurance agents, you can create geo-targeted campaigns concentrating just on the cities, ZIP codes, or areas you service.

This guarantees that clicks from persons outside of your licensed areas are not costing you money. Local targeting also enhances the human, approachable, and relevant aspect of your organization.

3. Control Over Budget

One of the best aspects of PPC is that you have financial control—that is, whether daily income is $10 or $1,000. Here there isn't a guessing game. You pick daily spending amount, set the maximum bid per click, and scale up or down depending on outcomes.

You are not bound into long-term contracts or mindlessly funding digital ads. Everything is fluid, quantifiable, and changeable right on demand.

4. Quick Results

Need leads now? PPC makes deliveries.

PPC advertising goes live virtually immediately unlike SEO, which might take months to show results. Your ads first show as soon as your campaign is approved. On the same day you start to get traffic and conversions.

PPC is the fastest path to awareness for insurance agents attempting to increase lead flow during sluggish seasons or support a limited-time offer.

Top PPC Platforms for Insurance Marketing

Not every click is generated equal. Where you run your adverts determines a lot of who sees them and their effectiveness. These are the best sites where ppc advertising for insurance agents can produce noticeable results.

Google Advertising

Most often used PPC platform by far. With about 90% of world search traffic handled by Google, most companies turn to it first.

Your insurance agency can show at the top of search results for pertinent terms using Google Ads. Additionally available to you are Google Display Network, which comprises millions of websites and apps, and YouTube advertisements.

It's best for catching folks actively looking for particular products or insurance companies.

Bing Advertising

Often underappreciated, Bing Ads—now Microsoft Advertising—can provide a reasonably priced substitute for Google Ads. Although its audience is smaller, the competition is also less, which usually translates into reduced cost-per-click (CPC).

Moreover, Bing users often lean older and wealthier, two important groups for some kinds of insurance, including life or retirement coverage.

PPC for Social Media

Hyper-targeted PPC marketing based on interests, job title, relationship status, income, and more is made possible by sites including Facebook, Instagram, and LinkedIn.

With the correct content, these ads—which lack search intent—can yet pique great interest. For instance, new parents would find enormous resonance in a Facebook advertisement endorsing "affordable health insurance for young families."

Before consumers begin looking, social PPC is great for brand recognition, remarketing, and audience building.

Get Seen by the Right Clients at the Right Time

PPC puts your agency in front of people actively searching for insurance. We’ll show you how.

Get a Free Audit

How to Use PPC for Insurance Company

Launching a PPC campaign without a strategy is like setting sail without a map. Here's a clear roadmap:

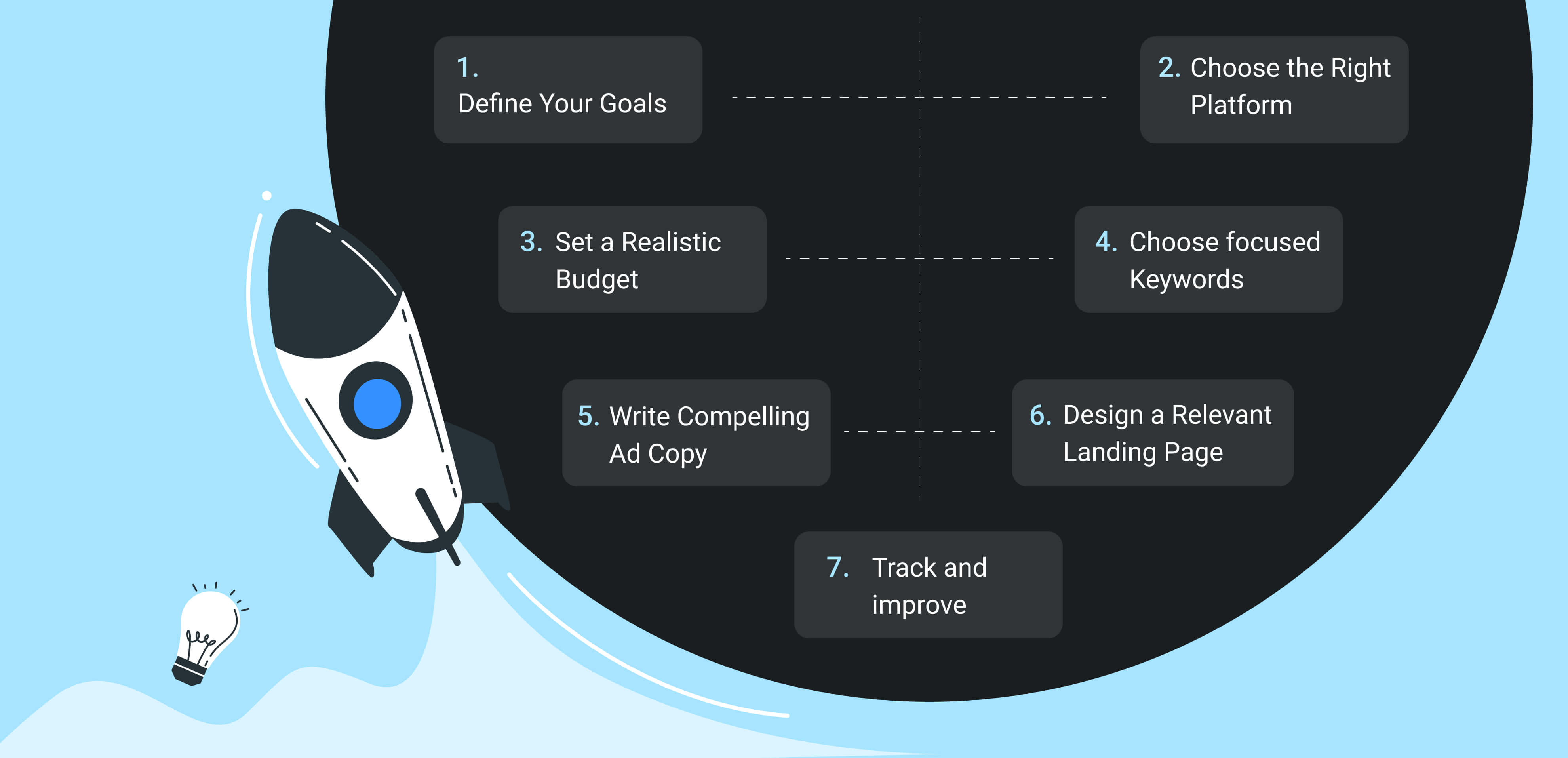

1. Define Your Goals

Are leads, phone calls, form submissions, or quote requests what you want? Describe specifically.

A good PPC campaign starts with well stated, quantifiable goals. If you are trying for awareness rather than conversions, your approach will look quite different.

2. Choose the Right Platform

Every organization finds different platforms to be useful. LinkedIn can be most suited if you are aiming for B2B clients or professionals. Google Ads with geo-targeting is more effective if your main concentration is homeowners.

Test several systems, compare their return on investment, and fund the ones producing qualified leads more heavily.

3. Set a Realistic Budget

Budgeting goes beyond simply your spending capacity. It's about how much you should spend to get where you want to be without running out of money.

Start modestly, track outcomes, and progressively spend depending on real performance.

4. Choose focused Keywords

Keyword research is the foundation of ppc advertising for insurance agents. Focus on search terms that reflect user intent. For example:

- “affordable renters insurance”

- “term life policy quote”

- “auto insurance near me”

Avoid generic, high-cost keywords unless you have the budget to compete.

5. Write Compelling Ad Copy

Ad copy should be benefit-driven, convincing, and unambiguous. Emphasize the special qualities of your agency—do you provide speedy approvals, bundle discounts, or 24-hour support?

Call powerfully to action with "Get a Free Quote" or "Compare Rates Today."

6. Design a Relevant Landing Page

Don’t send users to your homepage. Create dedicated landing pages for each campaign. These should include:

- A strong headline

- Benefits of your service

- Trust signals (e.g., ratings, reviews, certifications)

- A clear call to action

Consistency between your ad and landing page improves conversion rates and Quality Score.

7. Track and improve

PPC is beautiful in that nothing is fixed in stone. Based on performance, you should and can routinely change your campaigns.

Examine which ads are turning over, which keywords are wasting money, and which sites work best. Change bids; test fresh copy; stop underperforming ads—keep improving.

Keyword Strategy for Insurance PPC

So, you’re ready to set your PPC campaign in motion—but here’s the harsh truth: even the slickest ad copy in the world won't save you if you're bidding on the wrong keywords. Your keyword strategy is the steering wheel of your PPC campaign. Get it wrong, and you’re basically throwing money out the window. Get it right, and your insurance agency lands directly in front of high-intent buyers at the exact moment they need you.

Unlike other industries where you can afford to be a bit loose with keyword selection, ppc advertising for insurance agents demands precision. The cost-per-click (CPC) in this sector is notoriously high, sometimes upwards of $50 for a single click. So, choosing the right keywords isn’t optional; it’s survival.

Focus on Right Keywords

You're anticipating someone's mental process in a moment of need, not merely choosing words. Your keywords have to match searcher's intent, which changes greatly based on the type of insurance you are providing.

For example:

- Auto insurance prospects often look for price comparisons and quick coverage.

- Life insurance buyers tend to do more research and value trust.

- Business insurance customers often want comprehensive, tailored policies.

Your job? Match your keywords to their mindset.

Start by segmenting your keyword buckets:

- Branded keywords: e.g., “ABC Insurance Agency.” These bring in people already familiar with you.

- Non-branded but high-intent: e.g., “cheap car insurance in New York.”

- Competitor keywords: Yes, you can bid on competitors' brand names—though results vary and legal risks exist in some regions.

Pros: Targeted traffic, high conversion potential, better Quality Score from platforms like Google.

Cons: High CPC, requires ongoing optimization, can become very competitive.

Negative Keywords

Many insurance brokers spend thousands here by not using negative keywords. These are the words you wish your advertisement to show nowhere. Without them, you will quickly burn through your budget, show up in the incorrect searches, pay for pointless clicks.

Say you’re selling premium auto insurance. You don’t want your ads showing up for:

- “free auto insurance”

- “insurance jobs”

- “how to become an insurance agent”

Including these as negative keywords tells Google, "Thanks, but not thanks." I am not footing that cost.

Pros: Eliminates wasteful spending, improves ad relevance, increases ROI.

Cons: Requires regular review of search term reports, can accidentally block useful queries if you’re not careful.

Long-Tail Keywords

The magic of long-tail keywords lies in their specificity. These are longer, more detailed search phrases like:

- “best home insurance for new homeowners in California”

- “affordable health insurance plans for freelancers”

Long-tail keywords may have lower search volume, but they also come with lower competition and higher intent. Someone typing a five-word search probably knows what they want—and is closer to converting.

They also cost less. You can stretch your budget further by bidding on terms that the big guys aren’t watching.

Pros: Higher conversion rates, lower CPC, more qualified leads.

Cons: Requires more keyword research, may not generate large volumes of traffic on their own.

Let PPC Do the Heavy Lifting

With smart targeting and conversion-focused ads, you’ll get leads on autopilot.

Request Your Free PPC Plan

How to Track, Analyze, & Improve PPC Campaigns

Running a PPC campaign without analytics is like flying a plane blindfolded. You might be moving, but you have no clue if you're headed toward your destination or a mountain.

The biggest advantage of ppc advertising for insurance agents is measurability. Every click, impression, call, and form submission can be tracked, analyzed, and optimized. You just have to know what to look for—and what to do next.

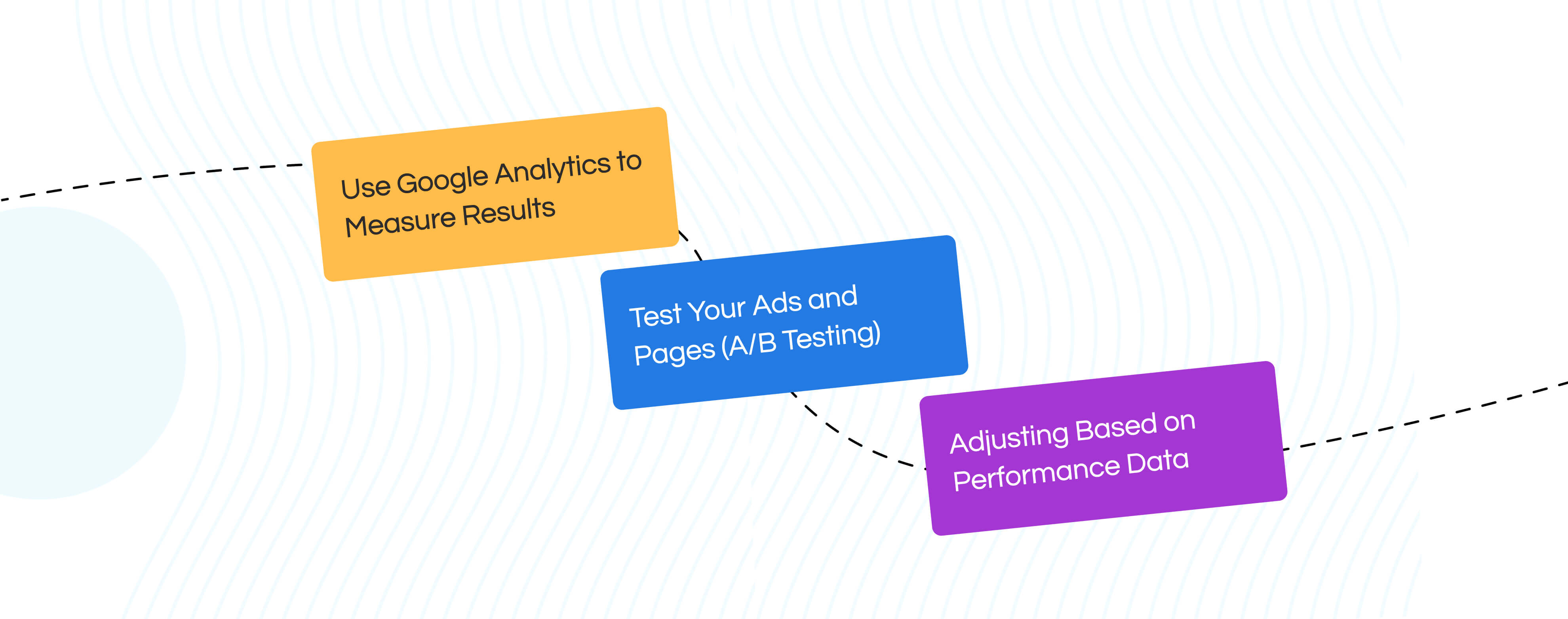

Use Google Analytics to Measure Results

Google Analytics (especially when paired with Google Ads) is your mission control. You can see:

- Where your traffic is coming from

- Which ads are bringing in leads

- What visitors do after clicking

- How long they stay on your site

And most importantly: Are they converting?

Set up conversion tracking to monitor actions like:

- Phone calls

- Form submissions

- Quote requests

- Email sign-ups

This lets you measure cost-per-lead and adjust your budget accordingly.

Pros: Full visibility into campaign performance, detailed audience behavior insights, great for long-term optimization.

Cons: Can be overwhelming for beginners, needs proper setup to avoid tracking errors.

Test Your Ads and Pages (A/B Testing)

Even expert marketers can’t predict which ad copy will win. That’s why A/B testing exists. You run two (or more) versions of an ad or landing page, change one element—like the headline or call to action—and see which performs better.

Apply A/B testing to:

- Headlines (“Get a Free Quote” vs. “Compare Insurance Plans Now”)

- Images or visuals

- CTA buttons

- Form layouts

- Landing page copy

Don’t make assumptions. Let the data do the talking.

Pros: Identifies top-performing elements, reduces guesswork, improves conversion rates over time.

Cons: Takes time and traffic to get statistically significant results, needs disciplined tracking.

Adjusting Based on Performance Data

Here’s the deal: a PPC campaign is never done. It’s not a “set it and forget it” system. Even great campaigns need regular maintenance.

Based on your analytics and A/B tests, adjust:

- Bids for high-performing keywords

- Budgets toward campaigns with a lower cost-per-lead

- Ad copy that’s not hitting CTR benchmarks

- Audience targeting if you're seeing poor conversions in certain locations or demographics

Also, look out for ad fatigue—when your audience sees the same ad so many times, they stop clicking. Rotate ads regularly to stay fresh.

Pros: Maximizes efficiency, ensures you’re always improving, protects ROI.

Cons: It requires ongoing effort, but it can get complex if you’re running multiple campaigns at once.

Conclusion

Running a profitable PPC campaign as an insurance agent is not about haphazardly funding ads and wishing for the best. It's about knowing your audience, precisely focusing on them, and providing value at each click. From selecting appropriate keywords to improving landing pages and performance data analysis, every action contributes to create a successful plan.

And here’s the real takeaway—you don’t need a massive budget to win. With the right approach, tools, and support, even small agencies can compete with big players. This is where affordable ppc management makes all the difference. It ensures your campaigns stay lean, efficient, and results-driven—without draining your resources.

Done well, PPC advertising may be the gasoline your insurance company runs toward measured expansion, better leads, and more conversions. All set to go first?

FAQs

PPC (Pay-Per-Click) advertising allows insurance agents to display targeted ads to potential customers searching for insurance services online. It drives high-intent traffic to your website, helping you connect with people who are actively looking for coverage. This means faster conversions and better ROI compared to traditional advertising.

Absolutely. PPC is scalable, making it ideal for agencies of all sizes. Even with a modest budget, you can target specific locations and demographics to attract qualified leads, without wasting money on uninterested audiences.

PPC for insurance advertising allows agents to target high-intent users actively searching for insurance policies. It provides precise budget control and fast, measurable results. With optimized campaigns, it enhances lead quality and boosts ROI.

PPC for insurance focuses on users who are ready to make a decision, resulting in higher engagement. By creating targeted ads and effective landing pages, agents can guide potential clients through the conversion process. This strategic approach improves conversion rates significantly.

Google Ads is the leading platform for insurance PPC due to its large audience and precise targeting options. Bing Ads can offer lower competition and cost per click, while social media ads like Facebook target specific demographics effectively. The choice depends on your target audience and goals.

Yes, PPC allows you to target specific geographic regions, making it ideal for insurance agents looking to attract local clients. With geo-targeting features on platforms like Google Ads, you can ensure your ads appear only to users in your area, increasing the chances of conversion.